After a decade-long romance with venture capital, Kissht has now finally set its IPO plans in motion. The lending tech startup has filed its DRHP with SEBI for at least INR 1,000 Cr public listing.

The Finer Print: The lending tech startup’s IPO will comprise a fresh issue of shares worth INR 1,000 Cr and an additional OFS component of up to 88.8 Lakh shares. Early backers, namely Vertex Ventures, Endiya Partners, and Ventureast, are planning to pare their stake as part of the OFS.

Of the total IPO proceeds, the startup plans to pump INR 750 Cr into its NBFC subsidiary, Si Creva Capital, to meet future capital requirements, while the remaining would be used for general corporate and other purposes.

Concerning Numbers: Beyond the vanity metrics, Kissht’s FY25 performance reads like a masterclass in deceleration and a market slump. Here’s a quick snapshot:

- Net profit declined 18% YoY to INR 160.6 Cr

- Operating revenue tanked over 20% YoY to INR 1,337.5 Cr

- Loan disbursements nearly halved YoY to INR 9,858 Cr

- AUM dropped to 56.9% in FY25 from 105.4% in FY24

- Repeat customer AUM fell to 73.3% from 84.7%

Any Silver Lining? Despite the financial headwinds, the fintech platform added 1 Cr new users in FY25, expanding its total base to 5.3 Cr and 91.6 Lakh active customers. Alongside, the company also appears to be actively diversifying its offerings, suggesting that it is building multiple revenue streams.

However, the bigger question is: can Kissht reverse its declining fortunes and give hope to retail investors amid a string of lacklustre startup listings? While we ponder, here’s a sneak peek into Kissht’s listing plans.

From The Editor’s DeskThe Battle For Coworking Supremacy: The booming coworking space in India is set to cross the $3 Bn mark by 2030. While WeWork and DevX are lining up plans for the bourses, here’s how the listed ones – Awfis, Smartworks and IndiQube stack up against each other.

BlueStone’s Muted Debut: The omnichannel jewellery brand listed at INR 508.80 per share on the BSE, about 1.5% lower than its issue price of INR 517 apiece. On the NSE, the stock opened at INR 510, registering a 1.3% discount over the IPO price.

Ban On Real Money Gaming? The Union cabinet has approved the online gaming bill, which aims to prohibit all real-money games. The proposed rules also ban financial institutions from facilitating any transactions related to such platforms.

R For Rabbit Bags $27 Mn: The D2C baby products brand has raised the capital in its Series B round co-led by Filter Capital and 3one4 Capital. The 2014-founded startup offers baby care products such as strollers, car seats, baby gear, and ride-ons, among others.

Credgenics Acquires Arrise: The SaaS-centric debt collection platform has acquired its rival for an undisclosed amount to expand its on-ground reach. Arrise will continue to be helmed by the existing leadership team for a “minimum” period of five years.

Cedar-IBSi Nears Fund I Closure: The fintech-focussed VC firm has so far mopped up INR 100 Cr for its INR 175 Cr maiden fund. The fund, which aims to back 15-20 B2B fintech startups, has already made investments in Cogniquest and WonderLend Hubs.

Armatrix Eyes INR 18 Cr: The WTFund-backed deeptech startup is looking to raise the funds in its seed round led by pi Ventures. It has already bagged INR 4 Cr from Boost VC and Turbostart. The startup is building robotic arms for inspection and maintenance.

OpenAI’s Desi Pricing Tier: The AI giant has launched a new subscription plan in the country called ChatGPT Go, priced at INR 399 per month. The plan is being rolled out as an India-only option and can be purchased via UPI.

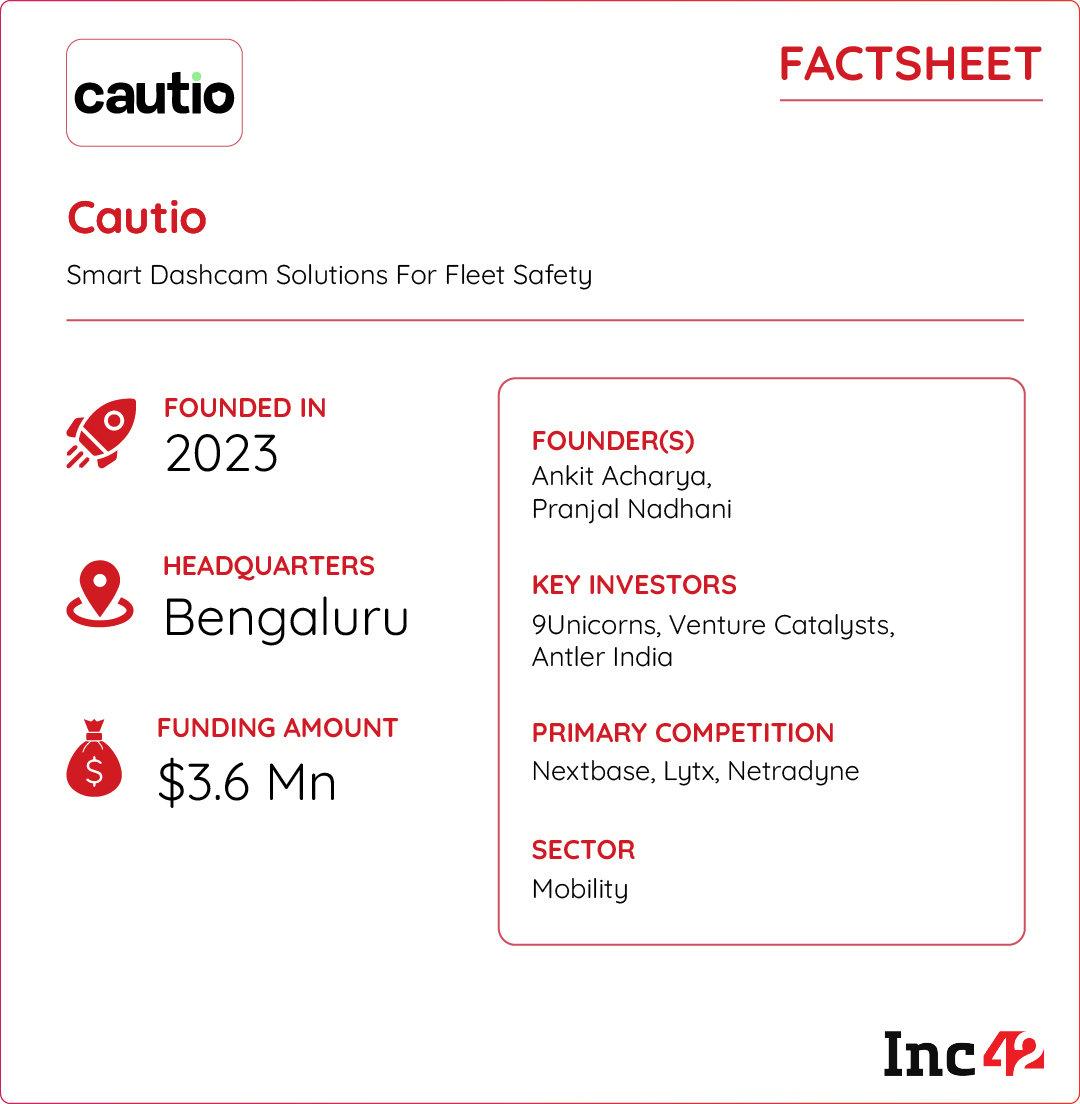

Inc42 Startup Spotlight Can Cautio Fix India’s Growing Cab Safety Crisis?Fed up with unsafe cab rides, former Namma Yatri executive Ankit Acharya and Pranjal Nadhani cofounded Cautio in 2023 to address a critical flaw in ride-hailing safety. The startup plugs the safety gap with its in-house AI-powered dashcam solution that moves beyond simple GPS tracking to redefine safety for fleet operators.

The AI Safety Net: Cautio’s full-stack solution uses a multi-camera system to provide a comprehensive view of the vehicle’s environment. While one camera monitors the road for hazards and driving patterns, a second tracks the driver’s behaviour for signs of fatigue, distraction, or aggression.

In the event of any unusual activity, the system instantly alerts the driver and sends real-time data to a central command centre, creating a proactive safety net.

Scaling In A Growing Market: The startup claims to have already deployed over 5,000 live units and has an order book for up to 16,000 more. With its pricing ranging from INR 750 to INR 1,900 per month, Cautio has set its eyes on capturing a lion’s share of India’s commercial telematics market, which is projected to grow to $6.9 Bn by 2033.

As it scales,can Cautio’s tech-driven approach redefine safety on India’s chaotic roads?

The post Kissht’s IPO Voyage, The Coworking Wars & More appeared first on Inc42 Media.

You may also like

The risk of this cancer is increasing rapidly among the youth. Be alert if you see these symptoms

'Masterstroke in bad policy making': Priyank Kharge tears into Centre over Online Gaming Bill

Mum explains her 'nightmare' after police officer steals her underwear 'I feel sick'

Will handover playschool teacher death probe to CBI, says Haryana CM

Humanity Is Not Confined To Humans Only, It Includes All Life Forms