Just last week, ecommerce major Amazon agreed to pay $2.5 Bn to settle a lawsuit filed by the US Federal Trade Commission (FTC), which alleged that the company “knowingly duped” millions of people into enrolling for Amazon Prime membership through “manipulative, coercive, or deceptive user-interface designs” aka dark patterns.

But in India, one of the largest ecommerce markets in the world, such rulings are rare. If anything, companies often claim they have self-audited themselves.

Like Flipkart did in July 2025 after the Central Consumer Protection Authority (CCPA) directed all major ecommerce platforms to carry out an audit to identify and eliminate dark patterns. But claiming this is one thing, actually sticking to the guidelines is another.

According to a survey conducted by LocalCircles, most ecommerce marketplaces in India are replete with dark patterns. Many of these have come to the fore after the spotlight turned to quick commerce dark patterns.

The survey claims just 3% of all ecommerce platforms were free of dark patterns. And the issue becomes especially evident during the festive season sales. This is the peak season for marketplaces and while heavy discounts are rolled out, they are often tempered with upselling and cross-selling through dark patterns.

As per a Redseer report, ecommerce marketplaces had a gross merchandise value (GMV) of $13.1 Bn during the 2025 festive season sales, which began on September 19-20, 2025.

A whole lot is on the line. In this high-pressure environment, a persistent, systemic problem is laid bare: ecommerce platforms are banking heavily on dark patterns to push shoppers into spending more, making faster purchases, and signing up for recurring commitments they may not actually want or even know about.

For instance, during Flipkart’s Big Billion Days and Amazon’s Great Indian Festival sales, several buyers have reported orders being cancelled after payment, refunds delayed, delivery dates pushed back, and “sale” prices that only matched or were worse than the regular listed price on the manufacturer’s site.

Like Amazon Prime, Flipkart uses its loyalty programme to drive early sales in the Big Billion Days period. This year, Flipkart Plus and Black members were offered early access and first dibs on top deals.

One customer Inc42 spoke with bought the same product at a discounted price without being a Flipkart loyalty programme member. This may just be a glitch in the platform, but it indicates that building a sense of urgency among customers is a major incentive ahead of peak festive season sales.

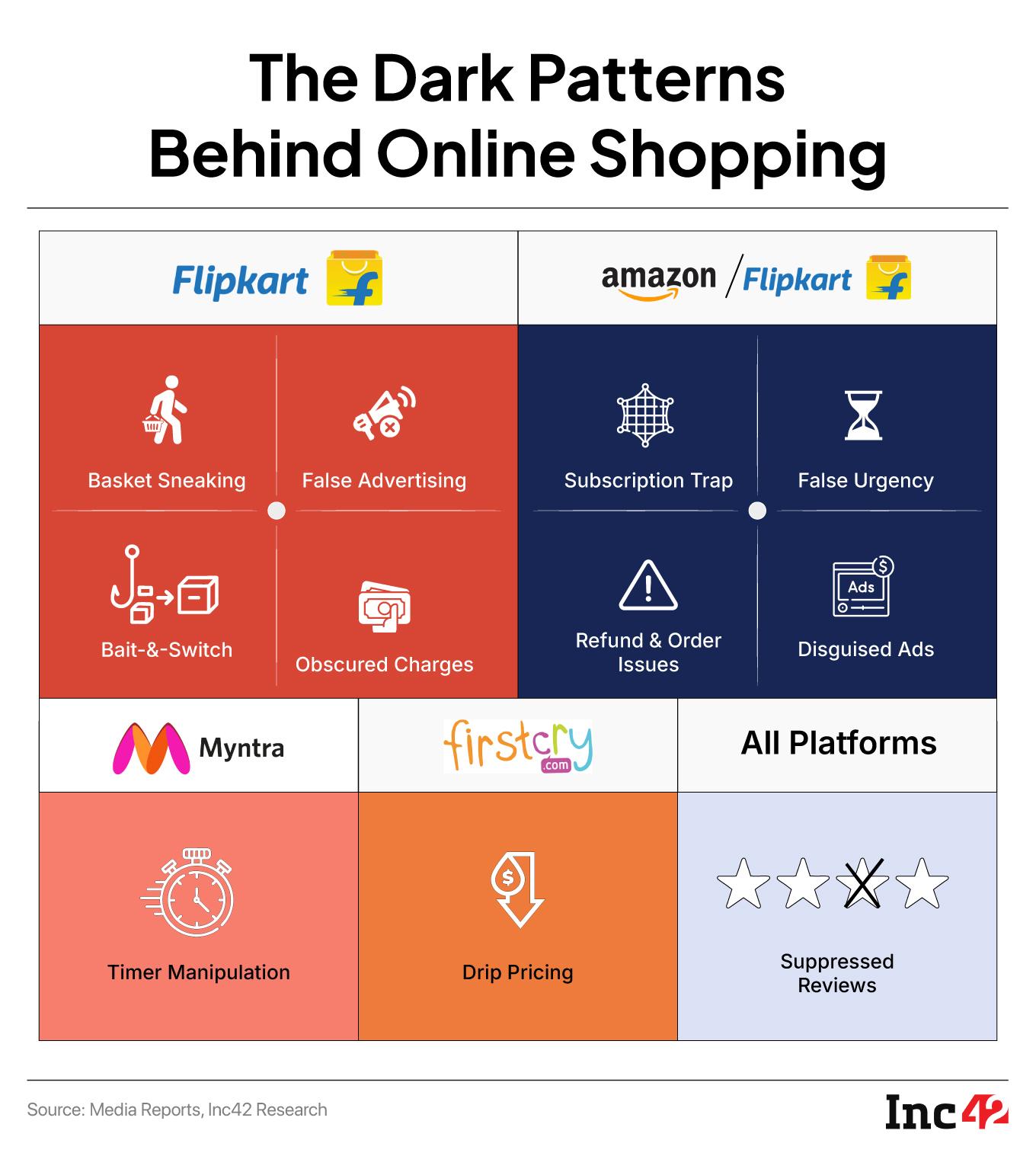

Bengaluru-based Flipkart is also reportedly involved in basket sneaking and false advertising. The marketplace reportedly added its “Trust Shield” to shopping carts for high-value products without customer consent, and a checkout process that obscures transport costs, preventing informed purchasing decisions.

In light of this forced purchase, InGovern Research Services, a corporate governance research and advisory firm, has asked the Ministry of Consumer Affairs to intervene following Big Billion Days order cancellations and misleading pricing practices.

There was also an issue of over-demand and scarcity. Several customers who ordered devices such as the Apple iPhone 16 at advertised sale prices experienced cancellations or stockouts during checkout. Despite this, Flipkart continued to promote deep discounts on these devices.

Speaking to Inc42, LocalCircles CEO Sachin Taparia said that basket sneaking is a common dark pattern but so is bait-and-switch. “You’re shown a gadget at INR 40,000 as a ‘lifetime best offer,’ but when you click, suddenly it’s INR 65,000. That’s rampant,” he said.

During the research for this report, LocalCircles claimed that some platforms allow users to add multiple discounted items to the cart, but later applied higher prices which was not crystal clear in the terms and conditions. “Consumers feel tricked because this was never disclosed upfront.”

While checking the platforms, Inc42 noticed that all the major platforms have an advertisement-led product placement just below the back button, effectively landing them to the advertised product’s page.

This not only makes the product placement a dark pattern, but marketplaces are also earning on these “misplaced ads”.

On fashion marketplaces, ‘steals’ or ‘drops’ often recycle the same items or simply reset the timer, which turns urgency into a behavioural nudge.

For instance, Flipkart-owned Myntra’s “Tick-Tock Steals” campaign employs a 60-minute countdown for select items, but the timer and inventory are often reset or recycled. Similarly, Flipkart’s flash sales repeatedly push countdown banners and “only X left” alerts, yet these are not always accurate.

Algorithmic Pricing GamesThose studying these patterns feel that while there’s nothing illegal about resetting a timer when the product is still in stock, it’s the FOMO or feeling of missing out and urgency that is being tapped into.

Indeed, the Indian government identified “false urgency” as one of 13 manipulative dark patterns earlier this year, and has even sent warnings to major players in the sector to reduce these practices.

However, not all of them come under dark patterns, like pricing for instance. According to Akshay Singh, a consumer protection lawyer who has argued in the Delhi High Court, marketplace price fluctuations, while unethical, aren’t dark patterns.

“Dark patterns involve manipulative interface designs that deliberately trick users into actions they wouldn’t otherwise take, simply changing the listed price, even strategically, isn’t inherently a dark pattern,” he said.

Adding to this, CCPA recently penalised FirstCry for misleading ads and unfair trade practices. The authority levied a penalty of INR 2 lakh after finding that FirstCry charged GST on products advertised as “MRP inclusive of all taxes,” effectively reducing the actual discounts shown to customers.

For example, a product displayed with a 27% discount was effectively sold at only an 18.2% discount after GST. The CCPA described this as “drip pricing,” a dark pattern which has previously been noticed on other websites as well.

Dynamic pricing is an area that many are concerned about, as seen in the furore over quick commerce dark patterns. Device or region-based pricing is unfair, say many consumer rights protection groups, but such methods are rampant and clamping down on this might severely impact ecommerce unit economics.

Year-Long Dark PatternsDark patterns are not limited to Flipkart and Amazon India, of course, or even the festive season only. They just become more visible during this time as platforms go all-out to drive sales and revenue.

Across the world, numerous digital platforms deploy manipulative interface designs that steer users into choices they may not otherwise make. Most of these are related to boosting the profitability of the transaction, as seen in the case of evolving charges in ecommerce, quick commerce and even travel booking.

On the IRCTC website as well, for instance, travel insurance is often auto-selected during ticket booking, requiring passengers to manually deselect it, a classic preselection tactic identified by the CCPA.

Similarly, platforms like MakeMyTrip and Goibibo have been flagged for showing false urgency, with messages such as “Only 1 room left at this price!” or “10 others are viewing this property right now,” which frequently turned out to be inaccurate or are just attempts to push faster bookings.

Earlier this year, we covered in depth the dark patterns rampant among all quick commerce platforms in India. With their focus also on impulse purchases to boost cart size and to extract maximum revenue per transaction, quick commerce platforms have come under fire for manipulative interface designs, pricing and unclear fees.

According to Taparia and others, the CCPA alone cannot curb these practices. Companies often fail to take voluntary guidelines seriously and therein lies the rub. “Guidelines are not enough, regulators must enforce audits and certifications,” he quipped.

As India’s ecommerce ecosystem evolves to become the world’s second-largest after China, sector-specific rules, and regulatory authorities must step up. While the Competition Commission of India has ruled on some anti-consumer matters in the past, these have largely dealt with monopolistic conditions. Is it time consumer protection authorities get more teeth as dark patterns rule India’s ecommerce landscape?

[Edited By Nikhil Subramaniam]

The post Flipkart, Amazon’s Mega Festive Sales Blighted By Dark Patterns appeared first on Inc42 Media.

You may also like

Top Gear fans taste test Clarkson, May and Hammond's gin and clear winner emerges

Over 11.31 lakh health camps organised under Swasth Nari, Sashakt Nari Abhiyaan: Govt

Cook 'thicker and tastier' beef stew by adding 1 simple ingredient to the pot

Jyotiraditya Scindia review projects in MP's Guna on death anniversary of Madhavrao Scindia

Bhopal News: No Helmet? No Problem! Petrol Pumps Serve Riders Helmet-Free As Rule Expires On September 29